By LYNETTE HAALAND, Four Points News

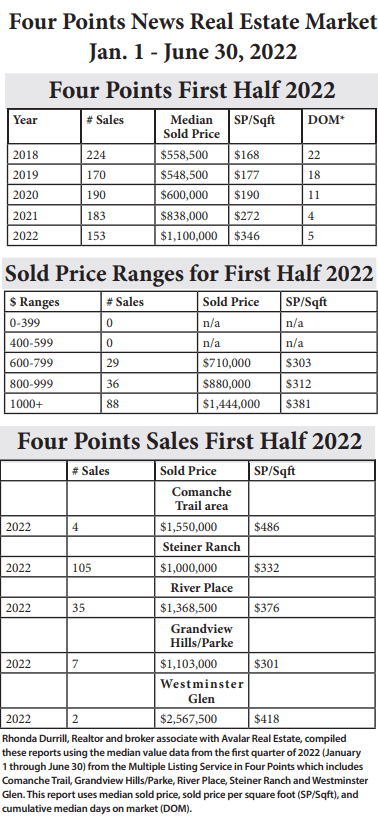

Home prices have increased significantly since this time last year. In the Four Points area in July 2021, the median house price was $838,000 and the median for this July of 2022 is up to $1.1 million.

In the first half of 2022, the median price per square foot in Four Points was $346 compared to $272 per square foot in 2021.

“Although home prices are high, the increase in inventory has made it a much healthier market for buyers,” said Rhonda Durrill, Realtor and broker associate with Avalar Real Estate.

“(Buyers) do not feel rushed to make a decision when walking in the door. Unlike earlier in the year, most homes are not selling over the weekend with 15-20 offers and buyers don’t have to offer crazy amounts over asking,” said Durrill, a Steiner resident.

Instead, buyers are now looking at comps and pending data with their real estate agents to come up with a fair and reasonable offer. Yes, there are some homes with multiple offers, but these are now more the exception than the rule, she added.

The number of homes sold in Four Points in the first half of 2022 has declined. From January through June this year, 153 homes sold in the communities that make up Four Points which include Steiner Ranch, River Place, Grandview Hills, Comanche Trail and surrounding areas. Last year during the first six month, 183 homes sold.

Several factors are affecting the local real estate market.

“First and foremost there is a huge increase in available inventory,” Durrill said. “In the first quarter, there were less than .5 months of inventory and now there is a whopping 2.5 months of inventory.”

To put it in better perspective, in the Four Points area of July 2021 there were 22 active listings, on July 1, 2022 there were 79.

Another factor affecting the market is working from home post pandemic, Durrill said.

Pandemic restrictions were virtually over by the first half of 2022 and people started to resume their normal life activities but the pandemic left a lasting change for many in the workforce.

“As restrictions eased, many employers realized they could allow employees to work from home either more often, or permanently,” Durrill said. “As such, people started fleeing the cities to the Austin suburbs for bigger, newer, and often less expensive homes and tax rates.”

Another factor affecting today’s market is that many homeowners heard about the hysteria happening in the real estate market in 2021 and early 2022.

“People heard stories, which are true, of homes going $100,000+ over asking. Rather than bypassing this opportunity to cash out, they are choosing to put their homes on the market now,” she said.

Now, however, the increased tax assessments are starting to drive out investors. There are no caps on the tax increase on investment properties.

“Higher taxes mean much higher rent and investors feel there will be a challenge filling their homes with tenants,” Durrill said. Some increases are estimated to be more than $7,000 in additional property tax on a modest home in Four Points. In the end, unfortunately, tenants will ultimately bear the cost of the tax increases, she added.

Interest rates are another factor that have increased considerably. In order to stay within budget, many home buyers are having to look for less expensive homes, which are hard to find, she said.

Durrill shares that it is still a seller’s market.

“Homes are still selling quickly at prices we never dreamed about two years ago,” she said. “My advice to sellers is to price their homes wisely, and reasonably, and to not let greed drive your decision.”

Clean and updated homes always get more interest and better offers.

In spite of the stock market, interest rates, and the political environment, Durrill – who has worked with out-of-state buyers this year from states other than California including Kentucky, Washington, and North Carolina – anticipates the real estate market will remain strong in the Four Point area.

“Why? This area has a lot to offer with good schools, reasonable tax rates, proximity to downtown and all that nature has to offer in our hills, trails, and lakes,” she said.

Austin-Round Rock MSA

In the first half of 2022, home sales in the Austin-Round Rock MSA decreased 7.7% year over year to 18,430 home sales. Sales dollar volume rose 7.7% to $11,904,623,551, while the median price increased 19.7% to $525,000.

So far this year, new listings are up 7.3% to 25,622 new listings; active listings skyrocketed 90.6% to 3,044 active listings; and pending sales decreased 12.1% to 19,305 pending sales. Homes spent an average of 21 days on the market from January through June 2022, one fewer day than the same period in 2021.

City of Austin

In the City of Austin, home sales in the first half of the year decreased 10.7% year over year to 5,789 sales, while the median price increased 15.1% to $610,000. At the same time, sales dollar volume rose 2.4% to $4,372,274,870. New listings decreased 0.8% to 7,788 listings; active listings increased 39.4% to 832 listings; and pending sales dropped 17.8% to 5,903 pending sales.

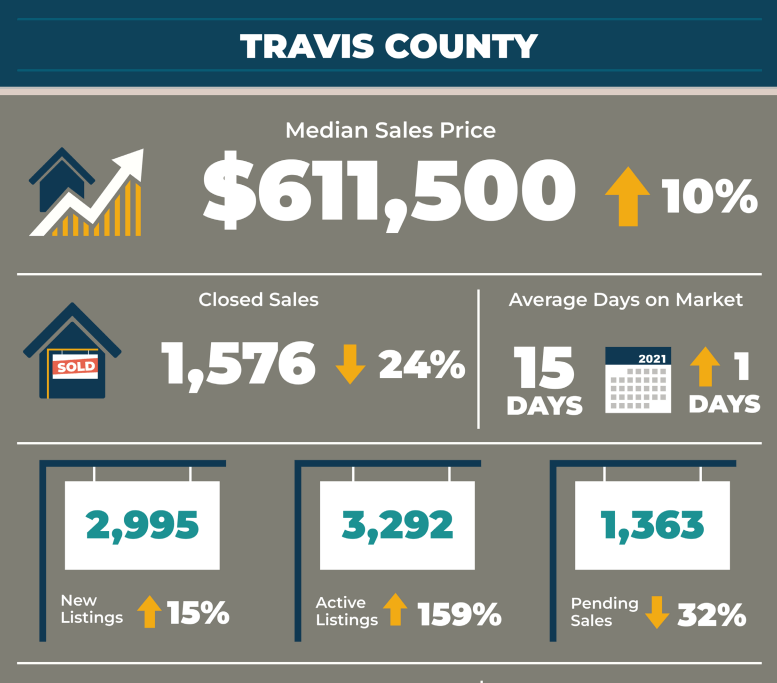

Travis County

From January through June in Travis County, home sales decreased 11.4% year over year to 8,920 sales. During the same period, sales dollar volume rose 0.9% to $6,716,534,179, as the median price increased 17.2% to $597,500. New listings saw an uptick of 2.9% to 12,266 listings, while active listings rose 58% to 1,420 listings. Pending sales fell 15.5% to 9,110 pending sales.

In June 2022, home sales decreased 24.7% year over year to 1,576 sales, while sales dollar volume dropped 16.1% to $1,240,583,715. During the same period, the median price increased 10.2% to $611,500. New listings increased 15.6% to 2,995 listings; active listings jumped 159.2% to 3,292 listings; while pending sales dropped 32.9% to 1,363 sales. Housing inventory rose 1.3 months to 2 months of inventory.

The Austin Board of Realtors is a nonprofit organization that has been serving Central Texas for nearly a century and has 14,000+ members.