By CASSIE MCKEE, Four Points News

By CASSIE MCKEE, Four Points News

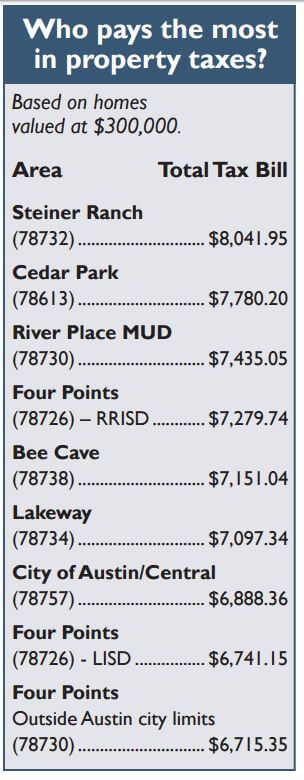

When it comes to determining annual property tax rates, the neighborhood one lives in can play a big role. Steiner Ranch is topping the list with the highest property taxes when comparing rates in Four Points and surrounding communities and cities.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools, streets, roads, police, fire protection and many other services, according to the state comptroller. Texas law establishes the process followed by local officials in determining the value for property, ensuring that values are equal and uniform, setting tax rates and collecting taxes. Taxes are collected at the county level by each county’s tax assessor.

School district comparison

School district comparison

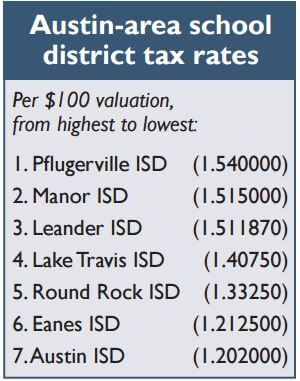

The largest share of the property tax bill goes toward the local school district. With a tax rate higher than surrounding districts, those living in Leander ISD will pay more tax each year. Leander ISD residents pay a tax rate of 1.511870 per $100 valuation. For a person living in a home with an assessed value of $300,000 after homestead exemptions are applied, that would mean a school district tax bill of $4,535.61 per year. That rate is higher than Lake Travis ISD (1.40750), Round Rock ISD (1.33250), Eanes ISD (1.212500) and Austin ISD (1.202000).

Veronica Sopher, assistant superintendent of community and government relations for Leander ISD, said the higher rate is linked to the district’s high rate of growth.

“We are a destination district, which means families are choosing to move into the district, so we have to build schools to accommodate our growth,” Sopher said. “Leander ISD is one of the fastest-growing school districts in Texas.”

Two Austin-area school districts have higher tax rates than Leander ISD – Pflugerville ISD, with a rate of 1.540000, and Manor ISD, with a rate of 1.515000.

Steiner Ranch residents pay more

After comparing property tax bills from several Austin neighborhoods in and around the Four Points area, it seems that those living in Steiner Ranch have one of the highest bills.

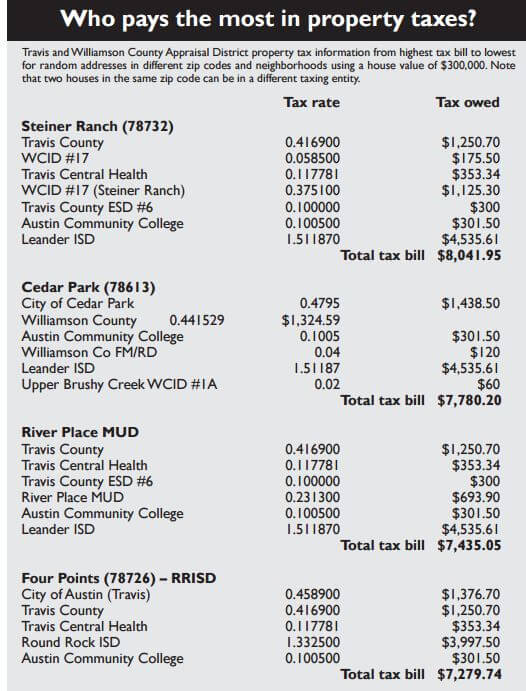

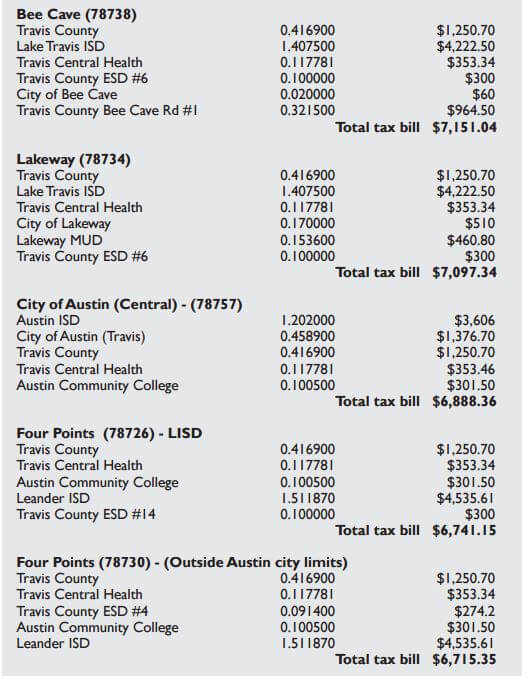

When all taxing entities are considered, a Steiner Ranch resident living in a home with an assessed value of $300,000 would have an annual tax bill of $8,041.95. Of that amount, $4,535.61 would go to Leander ISD.

In addition to school district taxes, Steiner Ranch residents also pay taxes to the Water Control and Improvement District 17, which manages residents’ water and wastewater.

“Steiner Ranch residents pay an additional tax for the infrastructure that was built by the developer by use of bonds,” said Linda Sandlin, executive assistant to the general manager of WCID #17.

Those living in Steiner pay the WCID #17 district-wide tax rate of $0.0585 and also a WCID #17 Steiner Ranch Defined Area tax rate of $0.3751. For the home valued at $300,000, those two items would add up to $1,300.80 per year.

“The defined area taxes are used to pay the annual debt service payments for the bonds that have been issued,” according to information provided by WCID #17. “These bonds were issued to partially reimburse the developer for all water and wastewater infrastructure.”

The total amount of Steiner Ranch Defined Area bonds which have been approved by the voters and issued is $118,500,000, according to WCID #17. Taxes are assessed each year to pay the annual debt payments on these bonds.

In addition, residents in Steiner also pay property taxes to Travis County, Travis Central Health, Travis County ESD #6 and Austin Community College.

River Place

A homeowner living in the River Place Municipal Utility District pays a slightly lower tax rate than those living in Steiner. River Place residents do not pay a tax to WCID #17 since their water and wastewater services are provided by the city, according to River Place HOA President Scott Crosby.

“Our water and wastewater are handled by the city of Austin effective November 2014,” Crosby said. “Prior to that time, it was handled by the River Place MUD, which remains in existence although its duties are now only for solid waste disposal and recycling, maintenance of the parks and trails within River Place.”

River Place is in the process of being annexed by the city of Austin. River Place homes north of Merry Wing have already been annexed, according to Crosby. The remainder of River Place will be fully annexed on Dec. 31, 2017.

“Overall, once that portion of River Place is fully annexed, we will no longer pay a Travis County ESD No 6 tax and our River Place MUD tax that we currently pay will be substantially reduced or eliminated, depending on whether the community votes to continue the MUD as a Limited District,” Crosby said. “(We) will however have to pay a city of Austin tax.”

Currently, River Place residents pay tax to Leander ISD, Travis County, River Place MUD, Travis Central Health, Travis County ESD No 6 and ACC. For a home valued at $300,000, that equals a tax bill of $7,435.05.

Central Austin

By comparison, a homeowner with a $300,000 house living in the 78757 zip code of central Austin would have an annual tax bill of $6,888.36.

That bill would consist of taxes to Austin ISD, the city of Austin, Travis County, Travis Central Health and ACC.

Effort to lower taxes

Texas has one of the highest average property tax rates in the country, with only 13 states levying higher property taxes, according to tax-rates.org. The site reports that median property taxes in Travis County are $3,972 for a home worth the median value of $125,800.

In June 2015, the Austin City Council approved a 6 percent property tax exemption for Austin homeowners.

In addition, Travis County, Central Health, and ACC all increased their senior and disabled homestead exemptions in 2015 to shave anywhere from an extra $5,000 to $10,000 off home values. (School taxes for those populations are already capped.)

However, the increase in the overall tax bill for the owner of a median-valued home in Austin is $242 over 2014, according to a report in the Austin American-Statesman.