Dan Troxell, Leander ISD superintendent,

has made multiple presentations

over the past several week in

the community about the details of

the 2017 bond proposal.

By NICK BROTHERS

Hill Country News

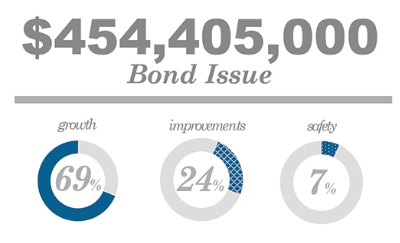

Early voting has begun and Leander ISD voters will decide to either enact or oppose a $454.4 million bond proposal that would construct four new schools, improve safety of facilities and accommodate for projected growth in the district.

LISD’s Board of Trustees called for the election at their Aug. 17 meeting, which will take place Nov. 7. Early Voting started Monday and runs through Friday, Nov. 3. For more information on when and how to vote, visit VoteTexas.gov.

Why is the bond being proposed?

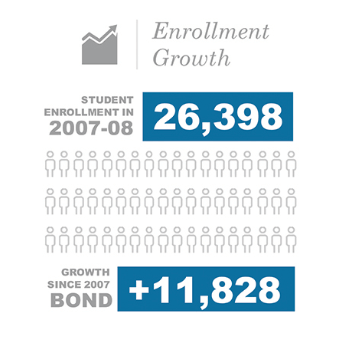

The last Leander ISD bond election took place in 2007, a year before the Great Recession and housing crisis in 2008. For a time, the effects of the recession slowed the district’s growth and the district was able to stretch the $559 million bond over 10 years.

Since 2007, the district has grown by 11,828 students, with a total near 39,000 students in 42 schools. The school district is expected to grow by 1,200 new students annually and add 123 new jobs per year. If the district continues to grow at such a rate, the district may need another bond proposal five years from now, according to district officials.

The rapid growth of the district was a major factor in the allocating of the bond’s funds, with more schools and improvements needed to accommodate for the growth throughout the next four to five years, said Victor Villarreal, co-chairman of the bond advisory steering committee.

The bond proposal process began in early 2017, with the formation of a 155 volunteer team of LISD community members who served on the bond advisory subcommittees and the steering committee. The diverse community members reviewed district data and reports, selected various improvement projects and made recommendations. The LISD Board of Trustees finalized the $454.4 million bond proposal and motioned to put it to a public vote in the Nov. 7 general election.

What will the bond do?

The $454,400,000 of the bond is planned to be divided and allocated into five categories: high schools, middle schools, elementary schools, technology and ancillary needs. In short, the bond will fund buying land, building and designing four new schools, and provide funding for safety and facility improvements for the district throughout the next four to five years.

A total of $172.5 million is slated for elementary school improvements, $117.5 million for middle schools and $96.7 million for high school improvements in the bond, and $38.7 million for technology needs, and $28.8 million for ancillary — which in this case means transportation needs.

The single largest recommended expenditure is for design, construction and furnishings for three new elementary schools as well as just the design of a fourth one, all for $123,320,048.

The second largest recommended expenditure is $63,410,011 for the design, construction and furnishing of a new middle school.

Land purchases for a future high school, middle school and seven elementary schools are also in the proposal at a combined cost of $61,934,695.

Finally, there are recommendations for the construction of secure vestibules at all LISD high schools and middle schools for a total expense of $17,621,008.

Designs for a seventh high school due in 2024 are projected to cost about $10 million, and more than $20 million is required for purchasing land for an eighth high school in the region.

Several improvements to area high school athletic facilities are in the proposal as well, including a $1.1 million expansion of grandstands at Vandegrift’s Monroe Stadium, replacing grandstands at Cedar Park HS stadium for $658,000 and increasing safety of dugouts and seating at CPHS and Leander HS.

Cedar Park MS, as well as Leander MS, are recommended for major maintenance to their HVAC systems, lighting, carpet and paint at a total estimated expense of $28,009,844. Both campuses are at the end of their service life and are due for facility and equipment refurbishing and replacement, said Shaun Cranston, co-chair of the appointed bond advisory steering committee.

For more information regarding the bond’s contents, visit www.leanderisd.org/bond2017.

What if the bond doesn’t pass?

If voters decide to vote the bond proposal down, the school district would have to reassess and consider low-cost methods to accommodate the district’s growth. This would likely mean adding more portable classrooms and redrawing district lines, said Corey Ryan, LISD chief communications officer.

The district has $18 million leftover from 2007 bond savings, which is assigned to build the next elementary school. That money could be reallocated in the event the bond doesn’t pass, Ryan said.

How will the bond be financed?

The bond proposal will not affect the current $1.54 by $100 valuation on property taxes, according to LISD. The $1.54 is formed from two tax rates, Maintenance and Operations (M&O) in $1.07 for day-to-day expenses, and Interest and Sinking (I&S) in $0.47 for paying off district debt.

“Because of the growth in our district and expanding our tax base as values go up, we’ll be able to make our payment even as we’re taking on new debt,” Ryan said. “We’re retiring existing debt and we’re taking on new debt all being able to do it at the existing $0.47 rate. This is based on a very conservative prediction of our growth on less than what our demographer says because we want to be cognizant and be able to be proactive in case something unexpected happens.”

Many residents ages 65 and older will be unaffected, as bond property taxes are frozen for qualifying senior residents who have filed a homestead exemption.

In the past, the school district has been criticized for using capital appreciation bonds (CABs), which require no payments for long periods of time, but leave future taxpayers footing the bill. However, in the last two years, the district’s finance team and board worked to restructure its debt load to move away from CABs and into capital investment bonds. As a result, the district has reduced its CAB exposure from 78 percent to 49 percent, saving taxpayers hundreds of millions of dollars. The district is aggressively pursuing opportunities to get that to 25 percent by 2025, Ryan said.

Additionally, the state does not fund school construction, safety enhancements or building improvements in LISD. All funds for school sites and construction are funded locally.

How soon will projects begin if the bond is enacted?

Projects will start with the first bond sale in summer 2018 and the building of the next elementary school in the following year. The district expects to have three to four bond sales over the course of the next four to five years.