By LYNETTE HAALAND

Four Points News

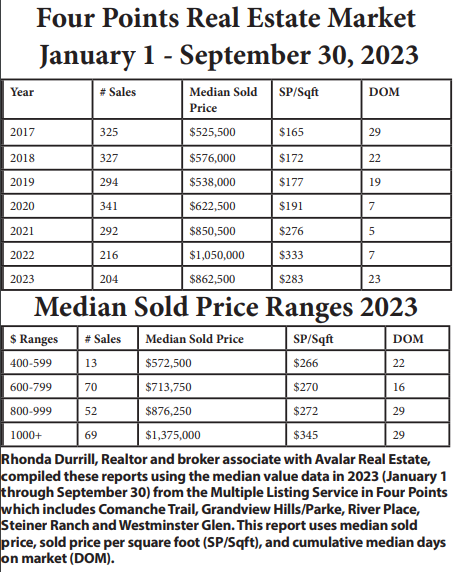

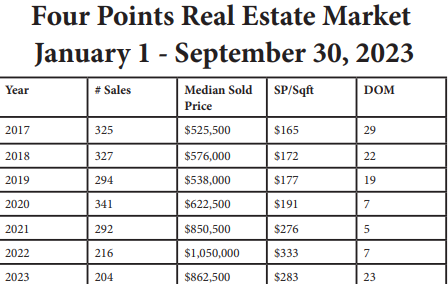

The median sold price in the Four Points area dropped some 17% to $862,500 in the first three quarters of the year compared to $1,050,000 last year. In the first nine months of 2023, there were 204 homes sold in the Four Points area compared to 216 homes in the same time period in 2022.

In general, prices are higher compared to 2021. Also 2023 third quarter prices are up from the first two quarters of the year.

“2023 has stayed strong with prices slowly rising from the 1st and 2nd quarters,” said Rhonda Durrill, Realtor and broker associate with Avalar Real Estate and a Steiner Ranch resident.

This year, the first quarter median price came in at $790,000 in Four Points. The 2nd quarter rose to $850,000 and the third quarter settled in at $862,500.

“Many neigh-sayers felt like 2023 would be a crashing market but real estate in the Four Points area stayed at or above 2021 pricing,” Durrill said.

Mortgage rates have climbed since the lowest recorded rate for a 30-year fixed-rate of 2.65% in January 2021. On October 19, Mortgage News Daily rates were 8% for 30-year fixed and 7.29% for 15-year fixed.

“High interest rates continue to pour cold water on the hot market, causing some to have to purchase a smaller home than in years past,” Durrill shared. “Some who have been waiting for the past year have lost out on homes that they can no longer afford due to the interest rates.”

“In the Four Points area, our 3rd quarter active listings have dropped almost 12% compared to this same time last year. Homeowners with low-interest rates are refusing to give those up and are choosing instead for home renovations or adding pools to their current homes,” Durrill said.

Another dynamic of the market is that cash deals are declining slightly from earlier this year in Four Points. Durrill crunched the numbers: 1st quarter 53 homes sold, 14 were cash or 26.42%, 2nd quarter 86 homes were sold, 19 were cash or 22.09%, and 3rd quarter 65 homes were sold, 11 were cash or 16.92%. All total, of the 204 homes sold this year, 44 were cash or 21.57%.

“We have always had a lot of cash deals (in Four Points). Even when the rates were much better. Especially in this area where people have money. Some folks just want to diversify their money and put some into real estate,” Durrill shared.

She added that cash deals over the past five years have stayed relatively steady: 2019- 20%, 2020-14.5%, 2021-20%, 2022- 22%, and 2023 year-to-date 21.57%.

Most homes coming onto the market are situations where the homeowner needs to move due to work or family matters, or investors who have gotten fed up with increased taxes and insurance, Durrill added.

Taking a wider view, home sales decreased in Austin and Travis County according to the Austin-Round Rock Metropolitan Statistical Area numbers in the Austin Board of Realtors September Central Texas Housing Report.

On another front, housing inventory reached 4 months of inventory, the highest level in more than eight years in the Austin-Round Rock MSA, according to ABOR.

The market also experienced a drop in closed sales, which decreased by 18% year over year and the median close price dipped 4% year over year to $452,080, both symptomatic of higher mortgage rates.

As the inventory of homes for sale continues to increase in Greater Austin, Clare Losey, housing economist for ABoR, noted that there is still a limited supply of affordable housing options available for Austin residents.

“While our current market shows signs of health with more housing supply becoming available, they are not necessarily attractive options for first-time homebuyers or those shopping for more affordable homes. The current inventory level across the MSA demonstrates that while we’ve seen a steady increase in supply over the past year, many of these homes are not attainable for the average Austin resident.”