By CASSIE MCKEE, Four Points News

By CASSIE MCKEE, Four Points News

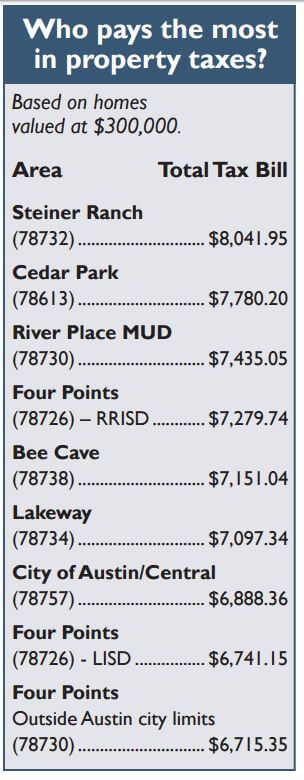

When it comes to determining annual property tax rates, the neighborhood one lives in can play a big role. Steiner Ranch is topping the list with the highest property taxes when comparing rates in Four Points and surrounding communities and cities.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools, streets, roads, police, fire protection and many other services, according to the state comptroller. Texas law establishes the process followed by local officials in determining the value for property, ensuring that values are equal and uniform, setting tax rates and collecting taxes. Taxes are collected at the county level by each county’s tax assessor.

School district comparison

School district comparison

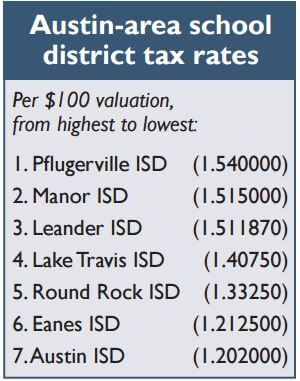

The largest share of the property tax bill goes toward the local school district. With a tax rate higher than surrounding districts, those living in Leander ISD will pay more tax each year. Leander ISD residents pay a tax rate of 1.511870 per $100 valuation. For a person living in a home with an assessed value of $300,000 after homestead exemptions are applied, that would mean a school district tax bill of $4,535.61 per year. That rate is higher than Lake Travis ISD (1.40750), Round Rock ISD (1.33250), Eanes ISD (1.212500) and Austin ISD (1.202000).

Veronica Sopher, assistant superintendent of community and government relations for Leander ISD, said the higher rate is linked to the district’s high rate of growth.

“We are a destination district, which means families are choosing to move into the district, so we have to build schools to accommodate our growth,” Sopher said. “Leander ISD is one of the fastest-growing school districts in Texas.”

Two Austin-area school districts have higher tax rates than Leander ISD – Pflugerville ISD, with a rate of 1.540000, and Manor ISD, with a rate of 1.515000. Continue reading